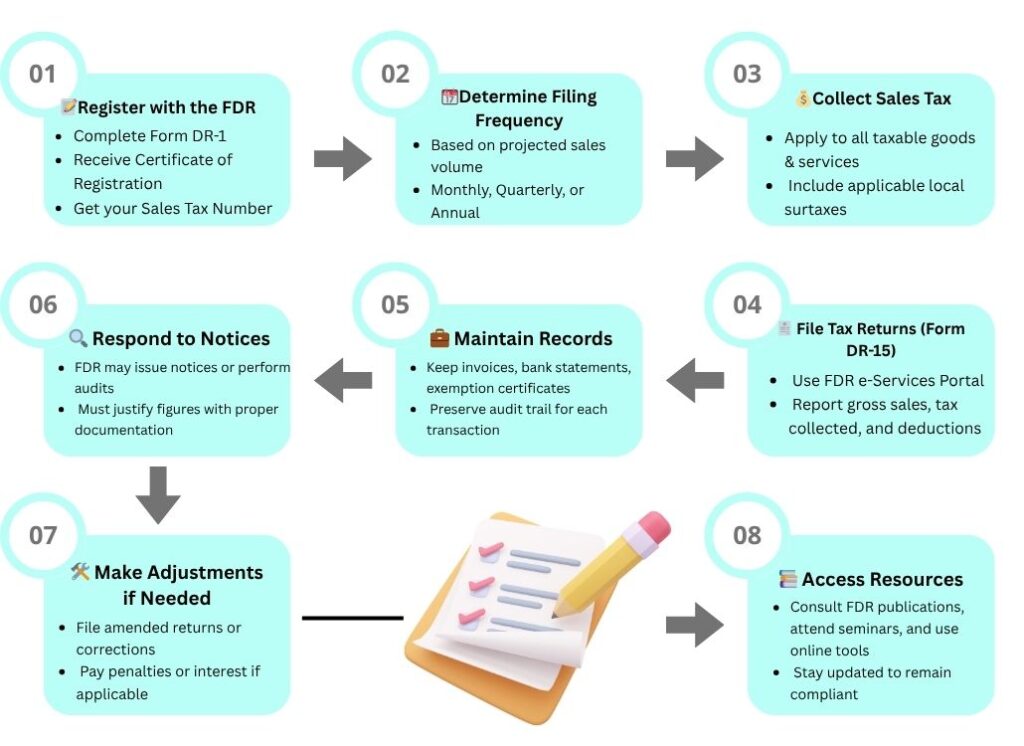

1.2 Role of the Florida Department of Revenue (FDR)

Once a business is legally established and begins operating within the State of Florida, it must comply with various tax obligations under the authority and supervision of the Florida Department of Revenue (FDR). This agency plays a central role in the proper functioning of the state’s fiscal ecosystem, as it is responsible for ensuring that all taxable economic activities are correctly reported, recorded, and monitored according to current legal standards.

As a government authority, the FDR oversees a wide range of tax programs, including Sales and Use Tax, Corporate Income Tax, and various local surtaxes. It maintains registration systems for businesses, issues regulatory guidance, processes tax filings and payments, conducts audits, and administers penalties for noncompliance.

✅ Tip for business owners:

Stay updated via FDR’s email alerts and check the Tax Information Publications (TIPs) section for annual changes.

Why Is the FDR Important to You as a Business Owner?

The following are the key areas in which the FDR performs regulatory and supportive functions:

Main Responsibilities of the FDR

It determines whether your business is required to collect Sales Tax

It gives you the official Certificate of Registration

It tracks your reporting through forms like DR-15

It can audit your business and issue fines or penalties for mistakes

Technical Assistance Advisements (TAAs)

A Technical Assistance Advisement (TAA) is an official written response issued by the Florida Department of Revenue (FDR) in reply to a specific taxpayer’s request regarding the application of Florida tax laws to a particular set of facts. This is not a general guideline—it is a legally binding advisory opinion that only applies to the taxpayer who requested it, and only under the circumstances they described.

TAAs are often used by business owners or their tax professionals when they face uncertain or complex situations, such as determining whether a new service is taxable or whether an exemption applies to a particular transaction. Instead of making risky assumptions, businesses can submit a formal request and receive a legally sound response directly from the FDR.

Example: If a digital marketing agency is unsure whether its services are taxable in Florida, it can submit a TAA request detailing the exact nature of the services it provides. The FDR will then evaluate the information and issue a ruling that clarifies the tax treatment.

Key Features of a TAA:

📝 It must be requested in writing and provide complete facts about the business scenario.

❌ The FDR is not obligated to issue a TAA for hypothetical or vague cases.

👤 The TAA can only be relied upon by the requesting taxpayer.

🔍 TAAs are publicly available in a redacted format to protect confidentiality, and other taxpayers can review them as informal guidance.

✅ Pro Tip: Reviewing past TAAs (available online) can help you avoid common mistakes or clarify taxability questions similar to your business model, even if you haven’t requested one directly.

DR-15 Form and the FDR’s Online Filing Platform

The DR-15 is the standard return form for reporting Florida sales and use tax. It is required for all businesses that have registered with the Florida Department of Revenue (FDR) as sales tax dealers. Depending on the business’s annual tax liability, the FDR assigns a monthly, quarterly, or annual filing frequency. This form is not optional , failure to file it accurately and on time can result in penalties, interest, and audits.

What Information Must Be Reported in the DR-15

The DR-15 requires detailed reporting of:

Gross sales: All sales, taxable and non-taxable.

Exempt sales: These must be itemized by exemption category (e.g., resale, manufacturing, government).

Local discretionary surtaxes: Specific to each county.

Tax collected: Amount collected from customers.

Tax due: Amount owed to the state and local jurisdictions.

Each field must reconcile with your internal accounting records. The FDR often cross-references these values with your federal income tax filings and electronic payment reports.

Tools the FDR Offers That You Should Be Using

Tax Rate Lookup Tool: For calculating local surtaxes

Taxpayer Education Seminars: Webinars, Q&A for small businesses

DR-15 Instructions: Step-by-step help for returns

Email Alerts: Subscribe to get law updates or deadline changes

e-Services Portal: https://floridarevenue.com/taxes/eservices

💡 COMMON ERROR: Many small businesses assume only physical stores collect Sales Tax. But digital products, rentals, and services may also be taxable.